Moorfield Group and Bricklane enter £600m UK PRS partnership

Residential for rent strategy uses proprietary technology to unlock institutional potential of existing UK housing stock

Residential for rent strategy uses proprietary technology to unlock institutional potential of existing UK housing stock

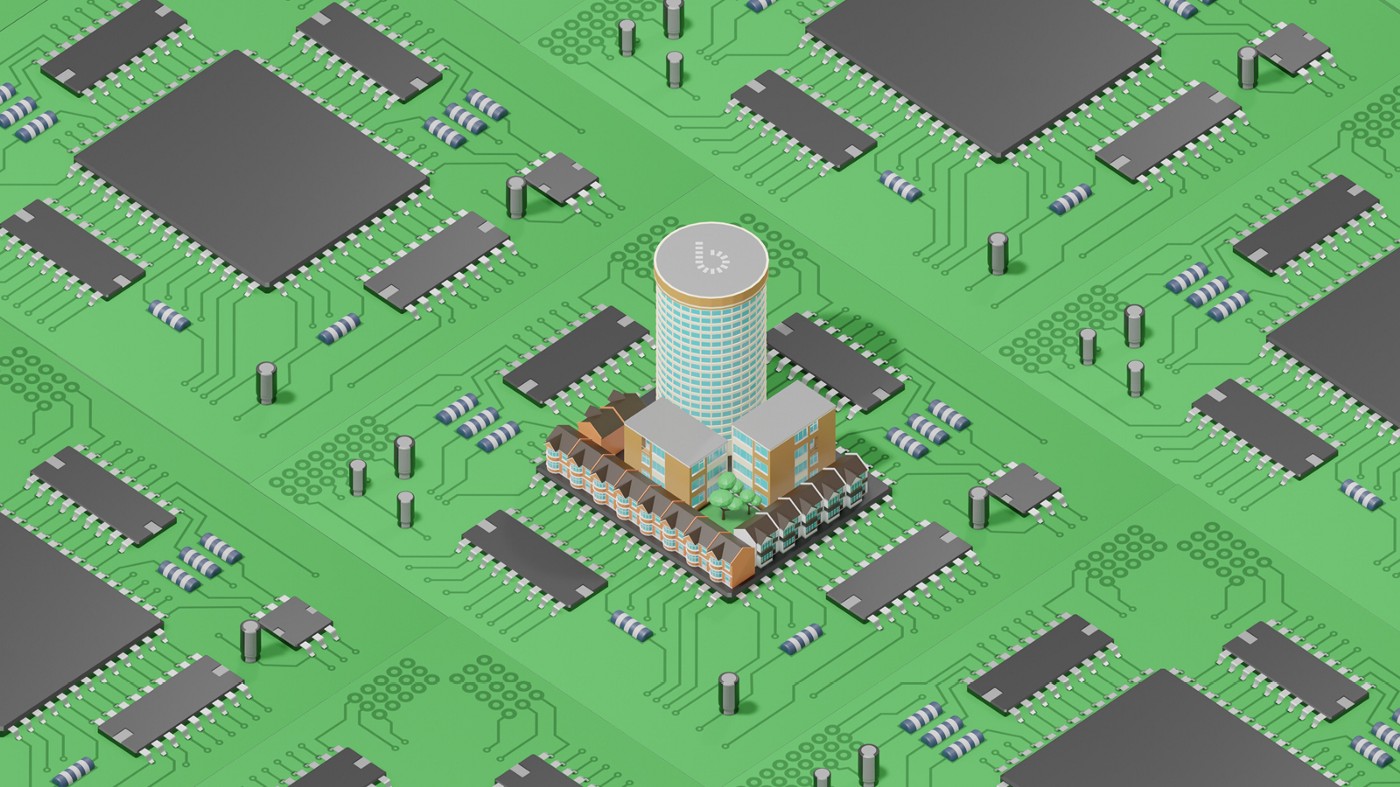

London, 21 April 2021 — Moorfield Group, the UK real estate fund manager, and Bricklane, the proptech residential investment platform, have established a partnership (the “Partnership”) that is targeting a £600 million UK portfolio of professionally managed homes for rent. The Partnership, which represents the most significant technology-driven investment in the UK’s residential market to date, will focus on unlocking the institutional potential of existing stock, with the investments to be acquired and managed by Bricklane through its proprietary technology platform, Compass.

The Partnership aims to acquire around 2,000 one to four-bedroom houses and flats over the next 24 months with an initial focus on London, Bristol and the South East. Using Bricklane’s technology, the Partnership will target attractive sub-markets with deep granularity, using unique bottom-up data to acquire rental properties that are expected to outperform in those areas at an unprecedented scale. Once units are acquired, the Partnership will seek to grow income and capital values through active asset management and refurbishment, with the aim of delivering a professional, high-quality proposition for tenants.

By focusing on existing properties, in particular the 98% of the rental market owned by the UK’s 2.5 million buy-to-let landlords, the Partnership expects to deliver attractive risk-adjusted returns and provide superior service and quality of home to a wider range of tenants, while also avoiding the carbon-cost of demolition and construction. This Partnership sees the UK beginning to follow the example of the US single-family residential market, in which institutional investment in existing granular properties has scaled from near $0 to $40bn in ten years.

Both Moorfield and Bricklane bring a strong track record of investing in and operating residential property. Bricklane specialises in acquiring and managing granular residential for rent across the UK, with existing portfolios in London, Leeds, Manchester and Birmingham. Moorfield, an early investor in the living sector, has a deep expertise in purpose-built student accommodation (Domain — since 1997), retirement living (Audley — since 2008) and Build To Rent (More. — since 2012). Moorfield also recently announced a partnership with We are Kin to focus on the one million bed HMO student accommodation market, with a number of portfolio and individual acquisitions already completed.

Ross Netherway, Head of Origination at Moorfield Group, said: “This Partnership provides us with an efficient and scalable means to find, buy, and manage individual residential properties for rent in our target markets. We are excited to be partnering with Bricklane who have the best-in-class capabilities — both human and technological — to help us deliver on our shared ambition. This Partnership will help further diversify our activities in our ‘beds’ theme and see us drive the professionalisation of a vast but fragmented market.”

Simon Heawood, CEO and Co-Founder of Bricklane, said: “The time is ripe for institutional capital to access and professionalise the mainstream Private Rented Sector. Demand is at an all-time high, while it is becoming less financially attractive for individual landlords to operate in the sector. Moreover, tenants are rightly demanding higher quality service and more secure contracts for their homes.

“Access to the mainstream market requires industrialising the acquisition and management of large numbers of individual assets, which is impossible without deep investment in technology. We have spent years building the technology platform, data science expertise and management experience to enable us to capitalise on this opportunity. We are very pleased to be doing this with a group of Moorfield’s track record and calibre, and the scale that this partnership brings will be transformational for our business, meaning that we are the leading platform of our kind in Europe. US operators have shown the potential of granular investment at scale and we believe that the UK’s population of renters deserves properties in which they can be truly at home.”

-ENDS-

Enquiries:

Bricklane: Claire Turvey, Andrew Davis

T: 020 3727 1000; E: bricklane@fticonsulting.com

Moorfield Group: Dido Laurimore, Richard Gotla, Methuselah Tanyanyiwa

T: 020 3727 1000; E: moorfield@fticonsulting.com

Notes to Editors:

About Moorfield Group

Moorfield Group is a leading UK real estate fund manager with a 25-year track record of investing across most sectors of UK Real Estate. Moorfield is especially well known as a vanguard investor in emerging sectors and has pioneered investment in student accommodation (since 1998), Build-to-Rent/PRS (since 2012) and senior living (since 2008). Moorfield also has an extensive track record in successfully identifying evolving investment themes in the office and industrial/logistics sectors.

Moorfield operates under an investment and asset management structure that enables it to be a vertically integrated (in-house) asset manager to the assets invested in, or to be a capital allocator using strategic outsourcing to proven operational/development partners. Moorfield’s in-house expertise and track record of partnerships uniquely positions it to identify and deliver high returning investment opportunities.

Since 2005 Moorfield has raised five private equity real estate funds; four Moorfield Real Estate Funds (MREFs) together with a dedicated senior housing platform, Moorfield Audley Real Estate Fund (MAREF).

About Bricklane

Bricklane’s technology platform unlocks the world’s largest asset class, residential property, for institutional investors. Through its proprietary Compass technology, the company has industrialised the investment process, from identifying the most attractive sub-markets based on proprietary bottom-up data intelligence, to programmatically acquiring outperforming properties intelligently and at scale. Tenants in Bricklane properties receive a professional, responsive service, with stable contracts for quality homes. Founded in 2016, the business is backed by a range of leading investors including LocalGlobe, A/O Proptech, DMG Ventures, and Zoopla.